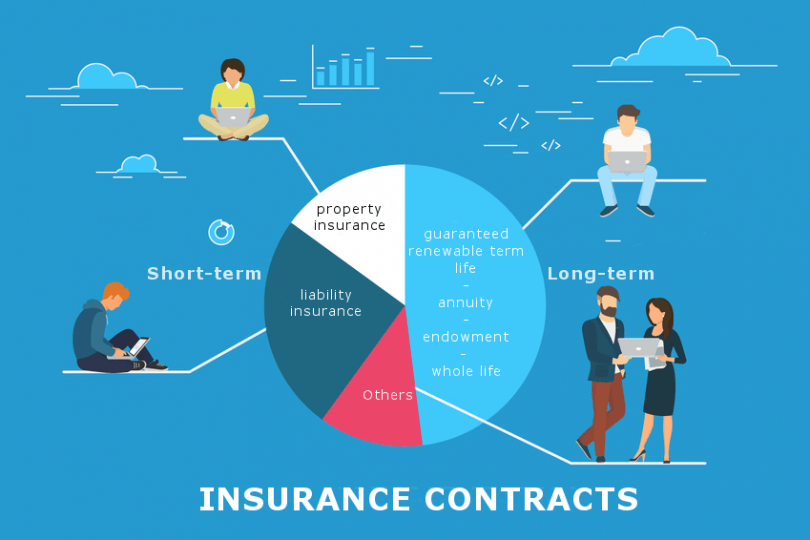

In the process of marketing and classifying policies, insurance entities divide their policies into two; long-duration contracts and short-duration contracts. The term long-duration contracts refers to contracts that you expect will remain in force for a lengthy period, for example, guaranteed renewable term life, annuity, title insurance contracts, endowment and whole life. All other insurance contracts fall under short-duration contracts, they include a majority of liability and property insurance contracts.

Differences between Insurance Long-duration and Short-duration Contracts

In order to understand insurance policies better, one must understand the differences between long-duration and short-durations contracts. They include:

Revenue

When considering revenue for short-duration contacts, insurers look at premium for the duration of the contract over the amount of insurance protection the insurer provides.

Alternatively, one can only recognize revenue from long-duration contracts when the premium is due. Additionally, the current value of expected future benefits the insurer will pay to or on behalf of policyholders minus the current value of future premium estimates the insurer is likely to collect from policyholders must be accrued when recognizing premium revenue.

Claims

In short-term duration contracts, claim costs that pertain to insured events that have happened but the insurer has not received official communication with regards to such events are only acknowledge after the insured event occurs. In long-term duration contracts, insurers acknowledge claim costs only when the insured events happen.

Regulation and Development of Long Duration Contracts

In February 2014, the FASB (Financial Accounting Standards Board) initiated discussions targeted at improving the accounting for insurance contracts with special emphasis on long-term duration contracts.

In the initial discussions, they came to several tentative conclusions:

- Insurers should update the assumptions they use to calculate (a) the liability for upcoming policy benefits for traditional long-duration contracts, participating life insurance contracts and limited payment contracts and (b) the added liability for universal life-type contracts

- Insurers must update these assumptumptiions on an annual basis in the fourth quarter of the financial year

- Insurers must acknowledge the impact the changes in assumptions have on their net income

- Insurance entities cannot include provisions for opposing adversities in their calculation of the liability

- Insurance companies are under no obligation to perform a premium-deficiency test

Since 2014, the FASB has had special focus on insurance contracts in an effort to explore possible improvements to existing U.S. GAAP. Generally, the focus is on the development of high quality guidance that addresses presentation, measurement, recognition and disclosure requirements governing insurance entities.

The regulatory process began with feedback from U.S preparers and investors, who were in favor of improvements to the current U.S. GAAP.

Conclusion for Long-Duration Insurance Contracts

In May 2015, the FASB issued the final standard for short-duration contract disclosures, which became effective at the close of 2016 financial statements. For long-term duration insurance contracts, the conversation is in progress with the FASB targeting changes that will improve the current accounting guidance, including open public participation in the process.