The recently announced strategic co-innovation initiative between Swiss Re, a global insurer and SAP SE, a market leader in enterprise application software promises to address challenges that affect financial steering and reporting of insurance companies around the world.

Update 01/2019: The result of the co-innovation is the product SAP FPSL -SAP S/4 HANA for financial products subledger

Today, insurance companies operate under strict and different valuation and reporting standards like the International Financial Reporting Standards (IFRS 9/ IFRS 17); remaining consistently compliant becomes challenging affecting insurers and reinsurers ability to collect reliable and comparable financial data. They also complicate the internal financial reporting process, which further affects operation costs.

The Swiss Re and SAP partnership is working on generating multiple valuations and introducing financial steering methods that will automate the process and improve efficiencies based on SAP HANA®.

In the past, Swiss Re and SAP have recorded tremendous progress on the same. Swiss Re comes with extensive industry knowledge that helps create a complex multi-variation accounting approach to address regulatory and operational issues. On the other hand, SAP offers SAP S/4HANA®, SAP HANA, and cloud-based solutions.

Through their partnership, Swiss Re and SAP will work towards developing a modular, flexible system, which will address operational challenges and improve productivity by introducing a sophisticated system that integrates actuarial, analytical and operational processes.

According to Gerhard Lohmann, CFO Reinsurance at Swiss Re, SAP was the right partner because of its excellence and long history developing solutions for global insurance companies.

Luka Mucic, CFO and Member of the Executive Board of SAP SE, also added that Swiss Re will bring on board its profound industry knowledge to help develop technology that will simplify the approach insurers and financial service providers have to their unique needs. Ultimately, the co-innovation partnership proves that the future in innovation is partnerships that are based on unique expertise and the mutual need to transform an industry.

The press release can be found at the homepage of www.swissre.com

Update 08/02/2018 Swiss RE & SAP Co-Innovation

Based on this news, the first step of the co-innovation by Swiss Re and SAP is completed. Based on SAP HANA the system supports multi-GAAP accounting for financial instruments and insurance contracts. In the next steps, the project team will extend the solution regarding financial analysis and steering with functionalities for forecasting, planning, and simulation of different scenarios.

What is Multi-GAAP Accounting?

International companies have to do normally accounting based on local regulation like HGB and international standards like IFRS or US GAAP. This leads to the fact, that accounting is quickly bloated and intransparent. With the help of new systems and approaches, this big challenge should be solved. One of the approaches is called “Mickey Mouse Accounting” officially known as “Multi-Gaap 2.0”. Mickey Mouse Accounting combines two accounting standards into one “IT”-system. Sorting of all accounts is done by three different account types – common accounts – IFRS accounts and local GAAP accounts.

SAP FPSL – SAP Financial Products Subledger

The result of the co-innovation between SAP and Swiss-Re is the product SAP Financial Products Subledger (SAP FPSL). SAP Financial Products Subledger is available since June 2018. With the help of SAP FPSL insurers and banks can do easily Multi-GAAP accounting and reporting.

Architecture of SAP FPSL

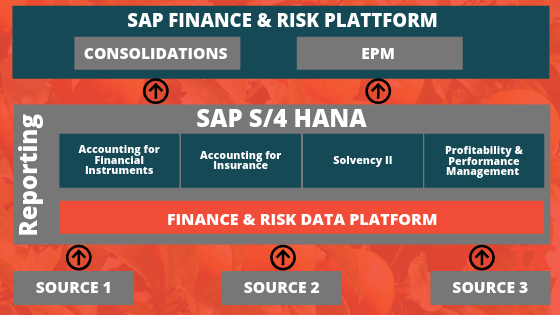

Let’s take a look at the architecture of SAP FPSL. As you can see in the graphic, different source systems can be used. The finance and risk data platform in combination with SAP S/4 Hana is the “counterpart” of the

SAP Finance & Risk Platform. Within the finance and risk data platform, several products are available like Accounting for Financial Instruments, Accounting for Insurance, Solvency II or Profitability and Performance Management.

what is the difference between SAP Insurance Analyzer and SAP FPSL ?

Hi Kavya,

the main difference of SAP Insurance Analyzer and SAP FPSL is the underlying technology smart Afi vs classic Afi (Accounting for Financial Instruments). Smart Afi runs on SAP HANA. Both solutions are based on the concept of subledger accounting for financial products. Smart Afi is taken advantage of the in-memory platform SAP Hana and therefore is more flexible and offers more speed in the mass data processing.

In both SAP Financial Products Sub-Ledger (SAP FPS) and SAP Insurance Analyzer (SAP IA) a central data storage (source and result data) in a unified data model is applied. SAP Insurance Analyzer is mainly focused on the accounting of IFRS 9 und IFRS 17. SAP FPS is a strategic solution with integrated accounting for insurance contracts and financial instruments, taking into account also other accounting principles such as US-GAAP or Solvency.

Best

Josh